TubiTV Just Hit 200 Million Users – Here’s Why

10 Perfect-Score Shows Buried on Prime Video Right Now

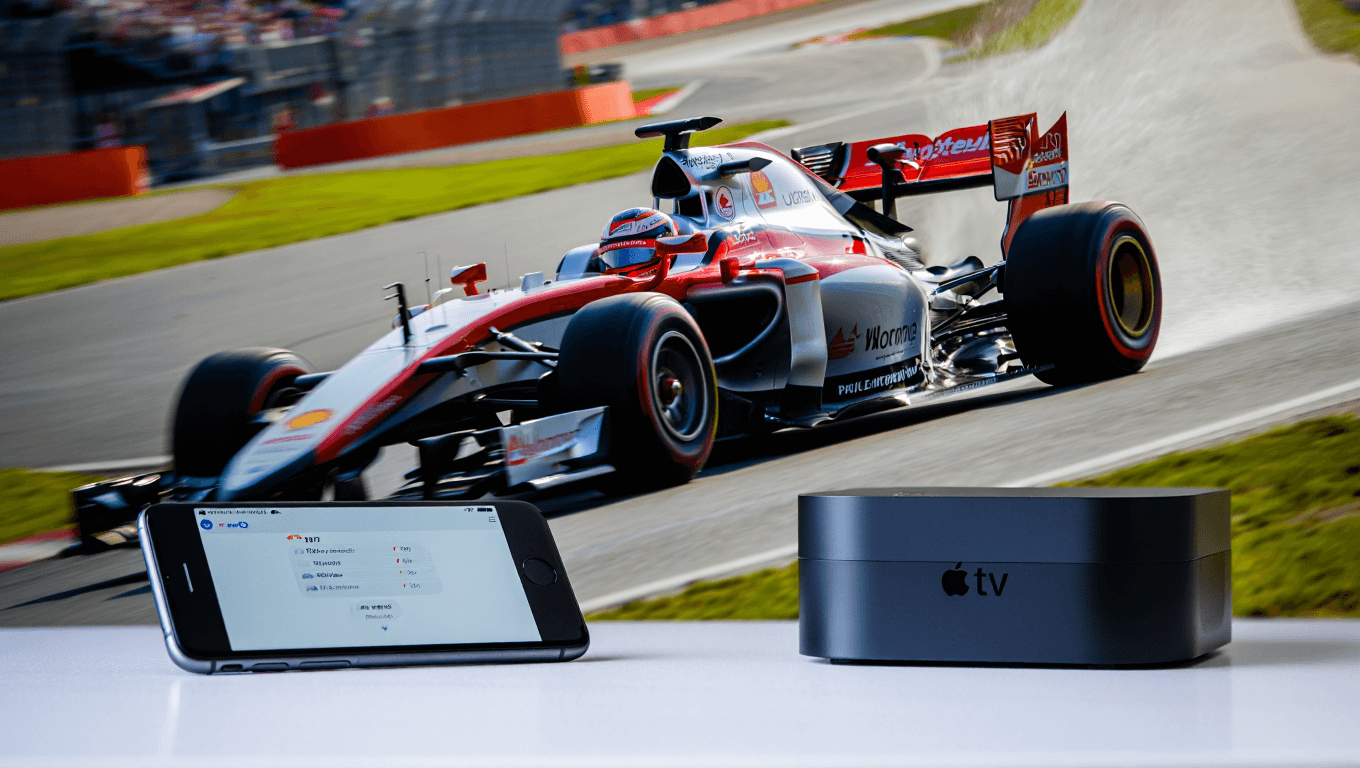

Fans felt shock as 2026’s five‑year pact dropped this week, and Apple quietly removed the “+” from its streaming name. The timing matters: Apple’s rebrand to Apple TV and a reported $750 million U.S. Formula 1 deal together mark a clear move into premium live sports. Variety and other outlets confirm Apple will stream all F1 races in the U.S. beginning 2026, with some sessions free and most behind subscription. Could this push change what you pay and how you watch live sports?

What Apple’s quiet rebrand and F1 pact mean for viewers in 2026

Apple rebranded Apple TV+ to Apple TV on Oct. 13; impact: brand overlap with hardware.

The $3.99 Streaming Service With 500+ Oscar Winners Nobody Knows About

Cancel These 3 Subscriptions Before November 1st – Here’s Why

Apple signed a 5‑year U.S. F1 deal, worth about $750M; impact: exclusivity from 2026.

Most races will be behind subscription; some practice sessions will be free to stream.

Why this 2026 streaming shift could reshape sports media access today

Apple’s moves arrive just as linear rights fragmentation accelerates and fans complain about rising subscription fatigue. The F1 agreement replaces ESPN’s deal and raises the likely cost and consolidation of premium live sports under big tech platforms. For viewers, the immediate stakes are price and convenience: Apple plans multi‑platform promotion across News, Music and its Store, which could push F1 deeper into everyday Apple use. Are you prepared to add another paid service to watch marquee live events?

How fans and industry reacted to Apple’s rebrand and F1 deal

Early social posts mixed amusement with concern as fans noticed the dropped “+” and the exclusivity risk for F1 access. Industry analysts flagged the deal as a strategic bid to turn sports into a year‑round acquisition funnel for services and devices. Many longtime F1 viewers warned about losing existing apps and subscriptions; others said Apple’s cross‑product push could make race coverage stickier.

Apple TV+ Being Rebranded as Apple TV https://t.co/W54EmJk6Pc pic.twitter.com/d0315HplFy

— MacRumors.com (@MacRumors) October 13, 2025

The viewing and revenue data that hint at a streaming sports surge

Apple will reportedly pay about $150M/yr on average under the five‑year pact, well above the previous $90M/yr ESPN baseline. Formula 1’s U.S. fanbase reached 52M in 2024, offering a clear volume play for subscriber growth and ad/partnership upside. Analysts say live sports still drive the biggest subscriber retention among streaming categories.

The numbers that change the game for streaming and live sports in 2026

| KPI | Value + Unit | Change/Impact |

|---|---|---|

| Deal value | $750M total | About $150M/yr, pays premium vs ESPN |

| Annual cost | $150M/yr | Significant uplift in rights spending |

| US fanbase | 52M (2024) | Large audience to monetize through subs |

Apple’s investment signals a bigger push into premium live sports and cross‑platform promotion.

Which voices warn Apple’s F1 move could raise subscription costs in 2026?

Some commentators view the pact as inevitable consolidation: a win for production quality, a loss for consumer choice. Apple says a “select” number of races and all practice sessions will remain free to the app, but most live races will sit behind the Apple TV subscription. That mix may placate casual fans while forcing dedicated viewers into paid plans.

Apple's TV Rebrand Marks the End of the "Plus" Era https://t.co/nuc5oocdDB

— The Hollywood Reporter (@THR) October 13, 2025

What this deal means for fans, cord‑cutters, and subscriptions in 2026

Expect sports to become a bigger reason to subscribe to fewer, deeper platforms. Apple’s cross‑promotion across apps and devices could add convenience – and pressure to consolidate your subscriptions. Will you pay more to keep watching your favorite races, or hunt for free streams and highlights?

Sources

- https://variety.com/2025/tv/news/apple-tv-plus-rebrands-streaming-service-1236551345/

- https://variety.com/2025/tv/news/apple-tv-formula-one-five-year-us-streaming-deal-1236554733/

- https://www.nytimes.com/2025/10/13/business/apple-tv-no-plus.html

Similar posts:

- Apple TV Reveals Rebrand In 2025 – Why Subscribers Should Care

- Peacock Premium Plus Lands On Prime Video For $169.99/Year, Why It Matters In 2025

- Peanuts Deal Extended To 2030 – What Apple TV+ Gains And What Fans Lose

- Apple TV Reveals 37% Discount With Peacock Bundle Oct 20, 2025 – Why It Matters

- Apple Rebrands To Apple TV In 2025, Reveals F1 Film Streaming Date

Jessica Morrison is a seasoned entertainment writer with over a decade of experience covering television, film, and pop culture. After earning a degree in journalism from New York University, she worked as a freelance writer for various entertainment magazines before joining red94.net. Her expertise lies in analyzing television series, from groundbreaking dramas to light-hearted comedies, and she often provides in-depth reviews and industry insights. Outside of writing, Jessica is an avid film buff and enjoys discovering new indie movies at local festivals.