TubiTV Just Hit 200 Million Users – Here’s Why

10 Perfect-Score Shows Buried on Prime Video Right Now

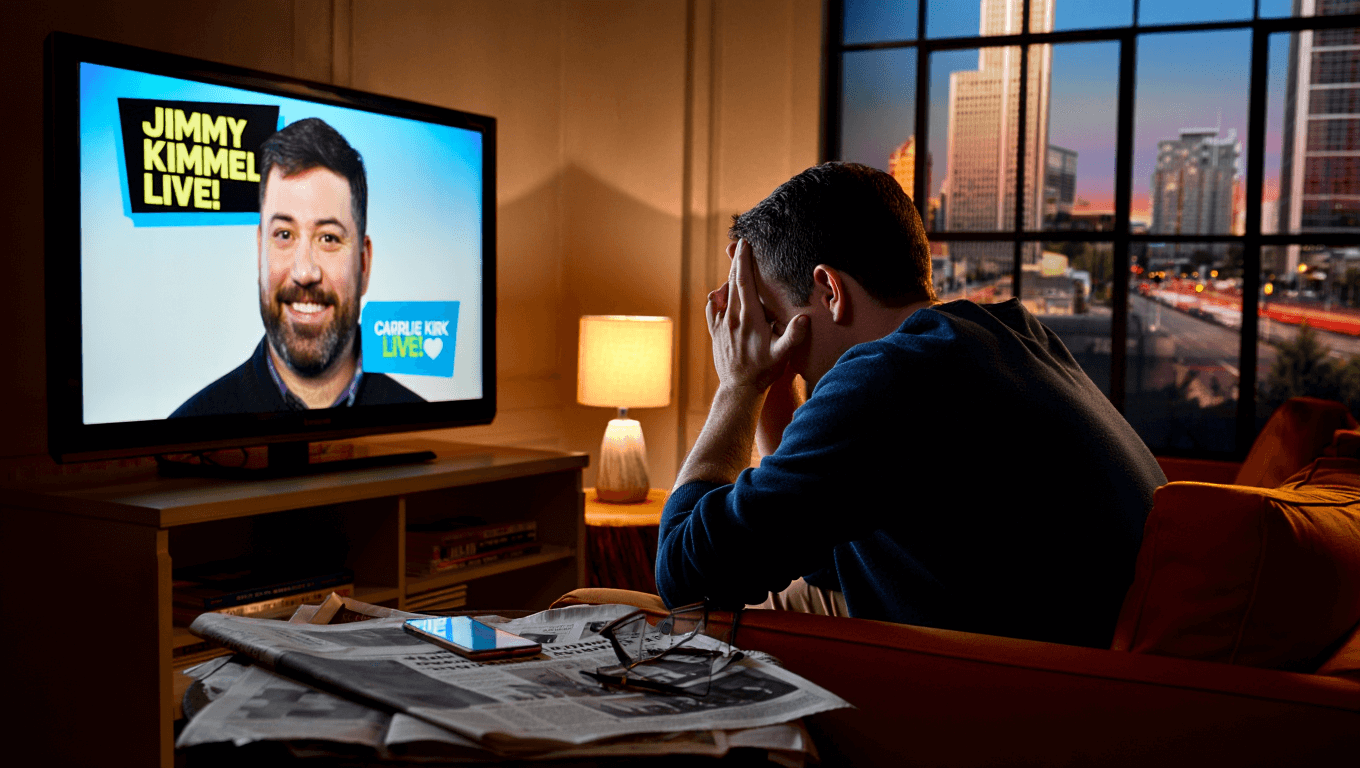

Outrage spreads as 23% of homes lost access to the episode. This week a large ABC affiliate group, Sinclair, announced it would air a Charlie Kirk remembrance instead of Tuesday’s late‑night slot, and vowed not to return Jimmy Kimmel Live! “until formal discussions” with ABC occur, per a Sinclair statement. The move matters because it removes the show from major markets while the FCC and Disney negotiate the fallout. This is both a ratings test and a corporate power play – who wins, and who pays the price?

What Sinclair’s Friday swap reveals about local broadcast power

• Sinclair announced a Charlie Kirk remembrance aired Sept. 19; impact: preempted Kimmel in many markets.

• Nexstar and Sinclair preemptions represent about 23% of U.S. households; viewers cut off in big markets.

• ABC paused Kimmel earlier this week; Disney and Kimmel later negotiated a return that still left local gaps.

Why Sinclair’s move might reshape local TV ownership in 2025

Sinclair’s statement escalates a network‑affiliate standoff amid a rare FCC intervention, creating a real‑time test of local station power. Stations that pull a national program can erase tens of millions of streaming and linear impressions overnight – and advertisers notice fast. This matters now because the action happened while ABC, Disney and the FCC were still negotiating responses, raising questions about affiliate leverage ahead of 2026 ad buys and affiliate renewals.

How colleagues and critics reacted within 48 hours of the preemption

The $3.99 Streaming Service With 500+ Oscar Winners Nobody Knows About

Cancel These 3 Subscriptions Before November 1st – Here’s Why

The reaction split quickly: peers and celebrities defended free‑speech concerns, while station groups framed the choice as accountability. Industry insiders note that pulling a late‑night staple is rare and signals an escalation in affiliate‑to‑network pressure.

Sinclair Says Kimmel Suspension is Not Enough, Calls on FCC and ABC to Take Additional Action

Sinclair’s ABC stations to Air Special in Remembrance of Charlie Kirk During Jimmy Kimmel Live! Friday Timeslot

Sinclair, the nation’s largest ABC affiliate group, objects to recent…

— Sinclair, Inc. (@WeAreSinclair) September 18, 2025

Several anchors and media figures blasted Sinclair’s move on social platforms.

Short scan: opinions polarized fast.

The numbers that show how 23% of U.S. homes and ratings shifted

Two quick data points show the stakes: linear reach and demo strength.

| KPI | Value + Unit | Change/Impact |

|---|---|---|

| Preempted households | 23% of U.S. homes | Major markets lost the episode |

| Live audience (Sept. 23) | 6.26 million | Spike vs recent averages |

| Adults 18-49 rating | 0.87 rating | Highest regularly scheduled rating in a decade |

Sinclair and Nexstar preemptions left major markets without the episode.

The numbers that change advertiser and affiliate calculus

Advertisers and networks watch these swings: a single preemption can alter CPM math and renewal leverage. The 6.26 million live viewers for Kimmel’s return (early Nielsen) and the lost reach from 23% of homes create an immediate revenue gap for local affiliates and national spots alike. Expect urgent advertiser calls and flashing red on market‑level revenue forecasts.

What this preemption means for late night ratings in 2025?

For viewers, the short term is simple: some markets saw a spectacle replaced by local programming or the Kirk special, while others got Kimmel’s return – producing fractured national audiences and a social‑media surge. For networks and station groups, the long term is riskier: affiliate preemptions could become a negotiating lever in content disputes and FCC posture. Will local owners extract concessions, or will advertisers push for standardized carriage to protect national reach?

Sources

- https://deadline.com/2025/09/jimmy-kimmel-live-replaced-charlie-kirk-tribute-sinclair-1236547662/

- https://deadline.com/2025/09/jimmy-kimmel-ratings-return-trump-charlie-kirk-1236553925/

- https://deadline.com/2025/09/jimmy-kimmel-live-off-abc-charlie-kirk-comments-1236547397/

Similar posts:

- Nexstar And Sinclair Resume Kimmel On Sept. 26, 2025; Why Affiliates Reversed Course

- Nexstar Reinstates Jimmy Kimmel on Sept 26, 2025 – Here’s Why It Matters Now

- “It Was Never My Intention” Sparks Station Boycotts In 2025 – Here’s Why

- “Has Anyone Ever Been Fired For Bad Ratings On A Wednesday” Sparks Outrage This Week, Here’s Why

- “If He’s Shut Down, I’m Shut Down” Sparks Protests As 32 Stations Preempt Kimmel In 2025

Jessica Morrison is a seasoned entertainment writer with over a decade of experience covering television, film, and pop culture. After earning a degree in journalism from New York University, she worked as a freelance writer for various entertainment magazines before joining red94.net. Her expertise lies in analyzing television series, from groundbreaking dramas to light-hearted comedies, and she often provides in-depth reviews and industry insights. Outside of writing, Jessica is an avid film buff and enjoys discovering new indie movies at local festivals.